Credit Card Payment Process

The seeming ease and simplicity of the credit card payment process is a illusion.

It masks a complex web of banks, credit card networks, and service providers that each do their part in the background (and, naturally, charge you for their trouble).

The guide below covers the details about the credit card payment process you’ll need to know.

Payments by Corporate Tools Request a Free Consultation

Table of Contents

Who’s Involved in the Payment Process?

If you read our general guide on How Credit Cards Work, you already know that accepting a credit card payment is essentially the same thing as receiving a loan, and that means the card payment industry is a risky business. Spreading around that risk is the main reason why there are so many players involved, and why credit card processing is generally so complex.

Of course, you can outfit your business to accept credit card payments without detailed knowledge of the credit card payment process, but the more you know, the better chance you’ll have of avoiding the missteps common to businesses accepting credit and debit card payments.

That knowledge really begins with learning how to talk the talk, so we’ll define the most important credit card payment key terms below before moving on to a detailed description of the stages involved.

Key Terms and Definitions

-

Credit Card Networks

A credit card network determines where a particular brand of credit card is accepted and sets the interchange fees for each transaction. There are four major credit card networks: Visa, MasterCard, American Express, and Discover. Credit card networks are also often called “card associations” and “card schemes.”

-

Cardholder

The cardholder is the customer or client who makes payments or purchases with a credit or debit card.

-

Issuers / Issuing Banks

The issuer grants the cardholder the right to use the card, determines the cardholder’s line of credit, and approves or declines the transaction. Most credit and debit cards are issued by banks that partner with either Visa or Mastercard, but American Express and Discover act as both credit card networks and credit card issuers. The issuer is also often called an “issuing bank” or a “cardholder’s bank.”

-

Merchant

The merchant is you—the business that receives the credit or debit card payment.

-

Credit Card Processors

Credit card processors or “payment processors” are the companies business’s hire to process their credit card payments. Credit card processors provide businesses with access to a merchant account through an acquiring bank and otherwise manage the merchant’s end of the credit card payment process.

Stages of the Payment Process

It usually takes just a few seconds for a credit card or debit card payment to go through, but in that short time a huge number of events take place. These events can be usefully divided into the stages described below.

Note: This page describes the credit card payment process in general. If you would prefer a less abstract approach that uses a simple, real-world example, check out our page on Buying Groceries with a Credit Card.

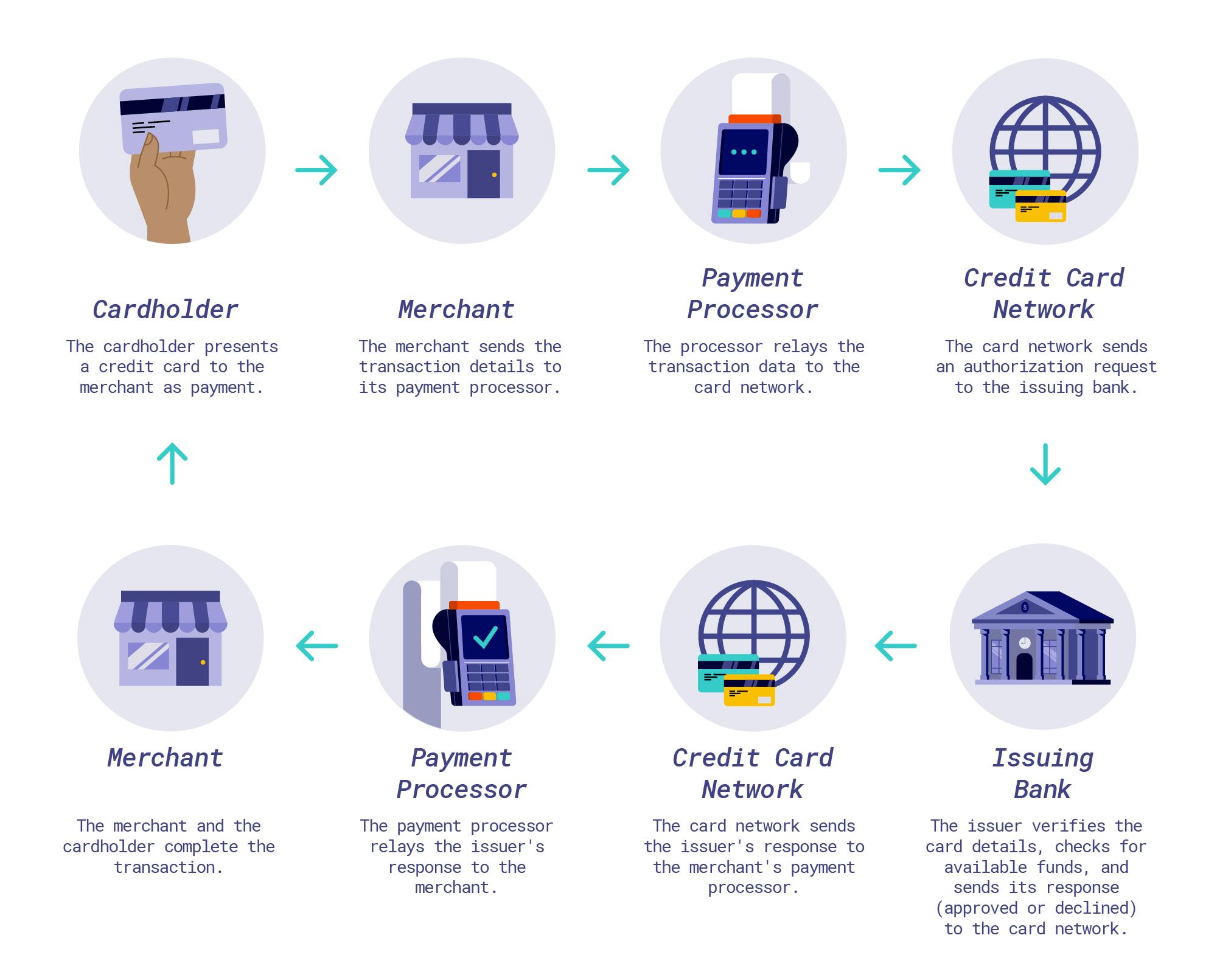

Authentication and Authorization

This is the stage most of us associate with the credit card payment process. It’s when the cardholder and the merchant interact—in person, by phone, or online—and complete their transaction. But there’s a lot happening in the background that we don’t see.

How Authentication & Authorization Works

-

Cardholder

The cardholder (the buyer) presents a credit or debit card to the merchant for payment. This can happen directly, as when a card is swiped, tapped, chipped or inputted manually in a traditional brick-and-mortar store, or it can take place by phone or online.

-

Merchant

The merchant (who the buyer is trying to pay) sends a request through a payment portal for the cardholder’s issuing bank to approve or decline the transaction. However, the authorization request doesn’t go directly to the cardholder’s bank. Instead, the merchant sends the required information through the merchant’s payment processor. (This is who a business hires to help them accept credit cards.)

-

Payment Processor

The payment processor receives the merchant’s authorization request and transaction information and forwards it to the appropriate credit card network (Visa, MasterCard, American Express, or Discover).

-

Credit Card Network

The credit card network receives the card information from the payment processor and forwards it to the cardholder’s issuing bank (in the case of Visa and Mastercard) for authentication and approval. This is the sense in which the credit card network is a “network”: it facilitates the transaction by acting as a highway along which transaction data travels back and forth between the payment processor and the issuing bank. American Express and Discover, however, are both card issuers and card networks.

-

Issuing Bank

The issuing bank checks the card and transaction details against the cardholder’s line of credit (if the payment is made with a credit card) or the cardholder’s account balance (if a debit card), and then then approves or declines the transaction. The issuer then sends its response back to the credit card network. If it approves the transaction, the issuer also places a temporary hold on the cardholder’s account for the amount of the transaction.

-

Credit Card Network

The credit card network sends the issuer’s response to the payment processor.

-

Payment Processor

The payment processor transfers the issuer’s response to the merchant’s payment portal.

-

Back to Merchant

The merchant receives the issuer’s response (approved or declined) and issues a receipt to the cardholder—which completes the transaction.

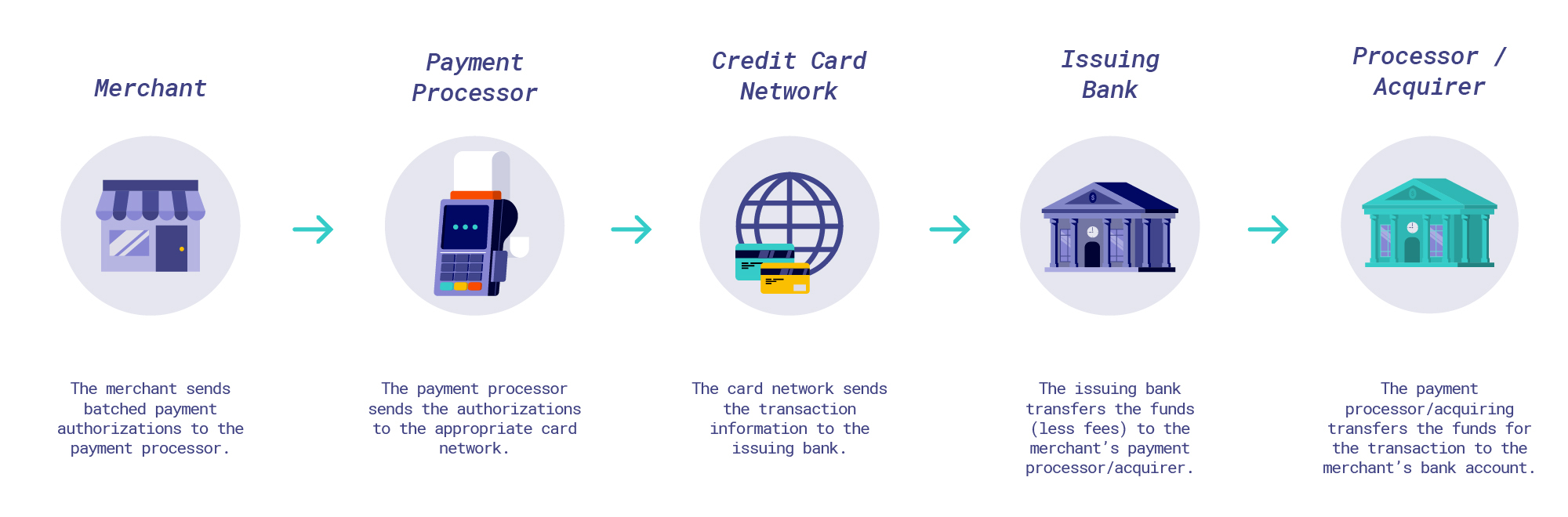

Clearing and Settlement

After the initial transaction takes place, the banks, payment processors, and credit card networks still have work to do. Money needs to change hands, credit card processing fees need to be paid to the appropriate service providers, and the funds from the credit or debit card payment itself need to make their way to the merchant’s bank account.

How Clearing & Settlement Works

-

Merchant

The merchant sends a “batch” of approved payment requests through its payment portal (usually at the end of the day).

-

Payment Processor

The payment processor receives the batch sent by the merchant, sorts the transactions, and transmits them to the appropriate credit card network. Transactions from Visa cards go to Visa, MasterCard transactions go to MasterCard, and so on.

-

Credit Card Network

The credit card network passes the transaction details on to the appropriate card issuing bank.

-

Issuing Bank

The issuing bank then debits or charges the cardholder’s account, subtracts the interchange fees due to the issuing bank, and sends the remaining funds to the merchant’s payment processor. (This is why banks like you to get a debit card or credit card with them. They make a small amount every time you swipe your card.)

-

Payment Processor / Acquiring Bank

The payment processor then routes the appropriate funds to the merchant’s acquiring bank, which deposits the money, minus fees, in the merchant’s bank account. (And, depending on your contract, your payment processor might take their cut right then or once a month.)

When Will Your Business Get Paid?

Unfortunately, that depends on your payment processor. Many merchant service agreements will default to depositing funds to your account days later, which is why it’s important to carefully examine your contract and negotiate 1-day deposits if you can.

However, even settled credit card payments aren’t automatically set in stone. This is because your customers still have the right to dispute their card purchases, reverse the transactions, and potentially get their money back—in some cases up to 6 months to a year or more after the transaction takes place.

These reversals or forced refunds are typically called either payment disputes or credit card chargebacks. Visit our guide on Credit Card Chargebacks to learn more.

UP NEXT: 1.3 Credit Card Processing Fees

How Corporate Tools® Can Help

The card payment industry is complicated, but you don’t have to go it alone. At Corporate Tools, not only have we provided this extensive guide to credit card processing for the DIY-crowd that likes to do things themselves, but we can also sign you up for credit card processing with a payment processor.

We work with a number of payment processors to provide low rates and contract terms for our clients. That means we can do the research for you, help you assess your options, and help you sign up with a payment processor that’s right for you.