Credit Card Processing Fees

Learn about Interchange Fees, Assessments & More

Thanks to credit card processing fees, the payment card industry is one of the most brilliant, monopolistic nickle-and-dime industries ever created.

You paying someone with a credit card enables about 8 different people to get a little piece of the action. We’re talking micro-charges millions of times a day. It’s an amazing process that we’re all beholden to.

Our goal is to help you understand credit card processing fees and help get you into a contract that minimizes your overall expenses when accepting credit cards.

Payments by Corporate Tools Request a Free Consultation

Table of Contents

What are Credit Card Processing Fees?

Credit card processing fees are essentially just service fees. But, if you’ve read the Corporate Tools® guide to the Credit Card Payment Process, you already know that it takes a lot of players to make the credit card payment process work, including card issuing banks, credit card processors, and credit card networks.

With so many moving parts, it’s no surprise that credit card processing generates a host of services and transaction fees.

What’s surprising is how complicated those fees can be, and how few of the credit card transaction fees you’ll pay can actually be negotiated and changed. Unless you’re a Walmart- or Amazon-level powerhouse, 95% of your overall costs are set and controlled with an iron fist by a few massive corporations. It’s the other 5% of your overall costs that provides at least some leeway to negotiate fees. But this is also where most businesses get screwed because they don’t understand how credit card transaction fees actually work.

Your best bet is to sign up with a salesperson who lets you have a decent contract and tries to minimize your overall costs—a service Corporate Tools® can provide. But no matter where you sign up for credit card processing, a salesperson can only influence the last 5% of the credit card fees you’ll pay. Banks and credit card networks will still control the bulk of your credit card processing fees.

This is why figuring out how credit card processing fees work brings practical advantages to any business. After all, every business that wants to accept credit card payments needs to choose a credit card processor or “payment processor” (the terms mean the same thing), and it can be hard to judge between your options without understanding the fees you’ll have to pay.

Types of Processing Fees

Even though you’ll typically only pay your payment processor directly, most of the credit card processing fees you’ll pay don’t go to your payment processor. They go to whichever financial institution performed the service that generated the fee, including your customers’ card issuing banks and credit card networks like Visa and Mastercard.

At the most basic level, we can break down the credit card processing fees into the following general categories:

- Wholesale fees (also called base costs):

Wholesale fees include interchange fees paid to card issuing banks and assessment fees paid to the various credit card networks. - Payment Processor Markups:

Markups are fees paid to your credit card processor on each transaction.

Wholesale fees make up the bulk of the transaction fees for any given credit card transaction. They’re commonly called “wholesale” or “base costs” because neither you nor your credit card processor have any control over the rates you’ll pay.

Wholesale fees are determined by the various credit card networks, such as Visa, Mastercard, American Express, and Discover, and they come in two forms: interchange fees and assessments. The interchange fee goes to your customer’s card issuing bank, and the assessment fees go to the credit card network.

We’ll discuss each type of credit card processing fee in detail below.

Interchange Fees & Rates

Interchange fees are “swipe fees” you’ll pay on every card payment you receive. Interchange rates typically combine a percentage of the sale with a fixed fee per transaction—for example, 1.58% + $0.10. Following this example, if you processed two credit card payments for a combined total of $200 at a flat rate of 1.58% + $0.10 per transaction, you would pay $3.36 in interchange fees:

1.58%($200) + 2($0.10) = $3.36.

More accurately, this $3.36 would simply disappear before you ever see your money at all. Mastercard would collect the $3.36 before the money ever reached your business bank account and use it to “reimburse” your customer’s issuing bank for funding and managing your customer’s side of the credit card payment process. This is why interchange fees are more accurately called “interchange reimbursement fees.” They serve to reimburse card issuing banks for their services.

What is the average interchange rate?

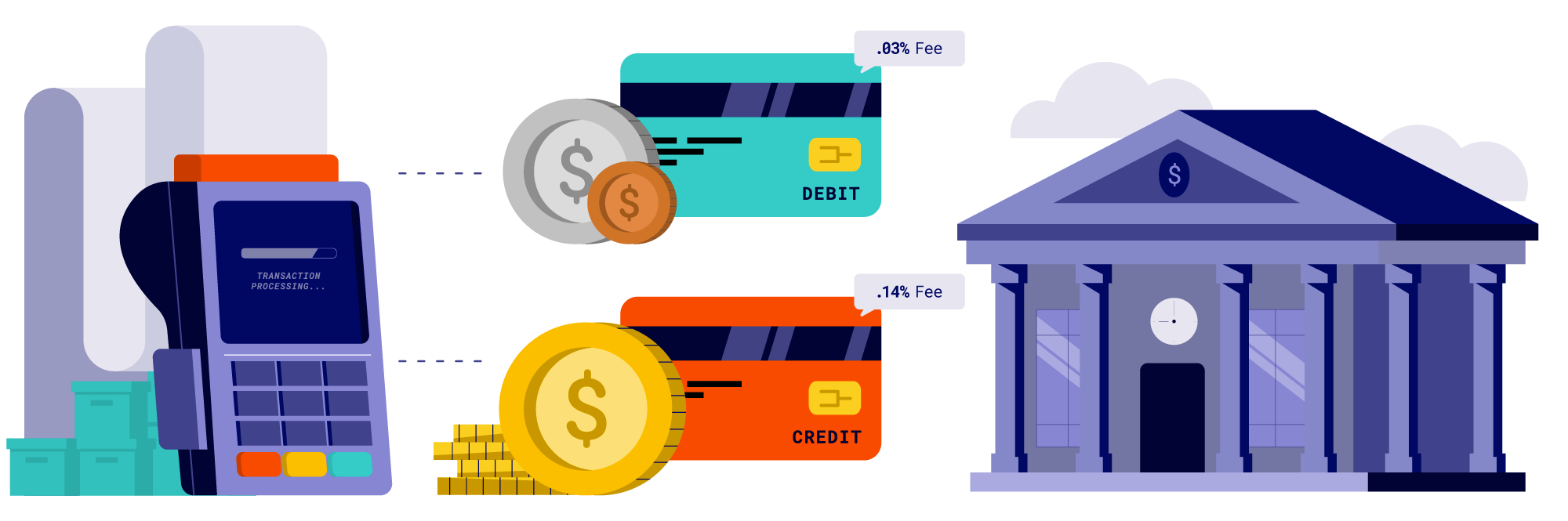

This is a common question with a common answer: In the U.S., interchange rates average 1.81% for credit cards and 0.3% for debit cards. But, in truth, the actual interchange rates you’ll pay can vary so widely that the notion of an “average interchange rate” is pretty close to meaningless.

It’s far more helpful to think of interchange fees in terms of their overall share of the fees you’ll pay to accept credit and debit card payments, and that share is big.

On average, you can expect interchange fees to represent somewhere between 70% and 90% of your credit card processing fees, even if we include service fees paid to your payment processor. No other type of credit card processing fee even comes close.

What factors determine interchange fees?

The card networks like Visa and Mastercard set their interchange rates for any given transaction based on factors like the type of card used to make the payment, the type of business you operate, and type of transaction (such as card-present vs. card-not-present transactions). In most cases, transactions that pose the highest risks for your customer’s card issuing bank will result in the highest interchange fees.

For a list of common interchange fees for Visa, Mastercard and Discover card transactions, visit our guide on Interchange Fees and Rates.

Below, you’ll find an overview of the main factors that affect interchange rates:

Card Types

Different types of payment cards pose different levels of risk for card issuing banks, so the type of card you accept naturally influences the interchange fees you’ll pay.

- Credit Cards vs. Debit Cards

Credit cards typically pose greater risks to issuing banks than debit cards, so credit card transactions usually have higher interchange rates. The interchange rate for a debit card payment at a supermarket, for instance, might be 0.05% + $0.21, whereas a credit card payment might carry an interchange rate of, say, 1.22% + $0.05.This is because a credit card payment is essentially a loan. The bank that issued that loan—which is your customer’s line of credit—is responsible for authorizing and funding the initial transaction. There’s always the possibility, of course, that the customer will never pay, so the risk for the issuing bank is high.Debit card payments typically pose fewer risks to card issuing banks because the funds for the transaction come out of your customer’s bank account, and the same logic holds true for prepaid debit cards, which also tend to have lower interchange fees than credit cards. - Rewards Cards

On the other hand, rewards cards present a different set of factors entirely. These are credit cards issued by banks that feature consumer rewards like cash back, hotel or travel points, and frequent flier miles.In general, rewards credit cards come with higher interchange rates than non-rewards credit cards. This isn’t precisely because rewards pose greater “risks” to card issuing banks. It’s because the issuing bank wants to recoup its costs for all of the perks it offers through the rewards program.And who typically pays those costs? You, of course!

Card Brands

Another major factor that influences interchange fees is the card brand itself, such as Visa, Mastercard, American Express, and Discover. Each card network determines its own interchange fees, as we noted above, so those fees often differ from card brand to card brand. This means that you might pay more or less in interchange fees depending on which card brands your business accepts. Card brands are also commonly called “card associations” and “credit card networks.”

Visa’s interchange rates and Mastercard’s interchange rates are, in fact, fairly similar, and they helpfully publish their interchange rates twice per year. American Express, however, is well known for its slew of premium cards and higher fees (which it calls a “discount rate”), and it doesn’t publish those fees publicly like Visa and Mastercard. This is partly why some merchants choose not to accept American Express credit cards.

Note: An interesting difference between American Express and its competitors Visa and Mastercard, is that American express issues its branded credit cards directly to consumers. Hence American Express is both a “card network” (like Visa and Mastercard) and an “issuing bank.”

Transaction Types

Another influence on interchange fees is whether or not the transaction is a “card-present” or “card-not-present” transaction. Because of the greater risk of fraud, transactions that take place without the merchant or customer manually swiping, chipping, or tapping the card tend to carry higher interchange fees.

Card-not-present transactions include payments made online, over the phone, and by mail. But they also include cases where you enter a card’s information manually because your credit card terminal can’t read the card.

Business Types

Interchange rates can also vary depending on your type of business. As we mentioned above, any business that makes sales online can expect to pay higher interchange fees for those card-not-present transactions, but every business falls into one or another category that might influence the interchange fees it pays.

Higher-risk industries, for instance, such as telemarketing, travel, and adult entertainment tend to pay higher interchange rates, simply because they pose an increased risk of credit card chargebacks and fraud. By contrast, lower-risk businesses like supermarkets and nonprofits tend to enjoy lower interchange fees overall.

When you sign up with your credit card processor, your processor will want you to describe the types of goods or services you provide, and they will use that information to assign your business a Merchant Category Code (MCC).

Card Network Assessments

The second type of wholesale fee is the so-called “card brand fees” or card network assessment fees. This is where the card networks like Visa and Mastercard take their cut. And, like interchange fees, assessment fees are set by the credit card networks, so payment processors and merchants have no power to negotiate lower assessment fees.

Of the two types of wholesale fees, assessments are probably the most confusing to merchants. This is partly a problem of terminology. On the one hand, the term “assessment fee” technically applies only to one type of fee charged by the credit card networks: a percentage charge based on volume. On the other hand, all sorts of service fees charged by the credit card networks are commonly called “assessment fees.” This is simply because they are all fees collected by the credit card networks, and they are all equally non-negotiable for merchants and payment processors.

To be honest, we don’t really care what you call them, as long as you understand the details that matter, so we’ll begin by covering the fees “properly” called “assessments” before moving on to other types of card network fees commonly grouped under the label “assessments.”

The table below illustrates the “true” volume-based assessment fees for each of the major U.S. credit card networks, as they apply specifically to credit card transactions:

|

Credit Card Network |

Credit Assessment |

|

Visa |

0.14% of all Visa credit sales volume |

|

Mastercard |

0.1375% of all MC credit sales volume (plus 0.01% for sales transactions greater than or equal to $1000) |

|

Discover |

0.13% of all Discover credit sales volume |

|

American Express |

0.15% of all AMEX credit sales volume |

A comparable volume-based assessment fee exists for debit and prepaid card transactions for both Visa and Mastercard (for instance, the Visa debit assessment is slightly lower at 0.13%), but you get the idea.

Other Card Network Fees

Of course, the fees you’re likely to pay to the various credit card networks don’t stop there. The networks charge various fees for international transactions, acquirer licensing, data usage, and so on and so forth—basically, any time the card network does anything it charges someone for it, and most of those charges get passed on to you.

Visa, for instance, charges an additional $0.0195 for every Visa credit card transaction—called the “Acquirer Processing Fee” or APF. So, if in a single month your business accepts 100 Visa credit card payments for a total of $100,000, you’ll fork over $159.50 to Visa from these two fees alone:

0.14%($100,000) + 100($0.0195) = $159.50.

Our goal, though, isn’t to slavishly run through a list of tiny, obscure fees, but to illustrate a crucial point about the credit card networks and the industry they control:

Because a handful of card brands dominate and control the card payment industry, and because merchants have pretty much no choice but to accept credit and debit card payments, it’s possible for the card networks to foist an unusually high portion of their operating costs on credit card processors and acquiring banks—costs that ultimately get passed on to merchants like you.

Payment Processor Markups

The wholesale fees discussed above—interchange fees and card network assessments—can’t be negotiated. They will stay the same regardless of your payment processor. Payment processor markups, however, are a different story.

Markups are the fees your payment processor tacks on to cover its own costs and generate profit, and markups can vary (sometimes wildly) from processor to processor. Some of that money goes to the acquiring bank that funds your merchant account (or the processor’s merchant account if you’re signed up with a payment aggregator).

As we discuss in our general guide on How Credit Cards Work, you’re essentially receiving a loan from an acquiring bank when you accept a credit card payment, and that involves risks for both the acquiring bank that funds the transaction and the payment processor that manages your end of the credit card payment process.

So, your processor’s markup partly serves to mitigate these risks and cover its own costs, which include money paid to the acquiring bank for its services. Of course, the markup is also there to generate profit for your credit card processor, which is why negotiating the right contract is so important.

To learn more about payment processor markups and the various pricing models different companies use, check out our guide on Credit Card Pricing Models.

UP NEXT: 1.4 Chargebacks

How Corporate Tools® Can Help

There’s no way around it. You’re going to pay boatloads of processing fees when you accept credit card payments, and half the time you’ll struggle to know what the fees are even for.

We get it. We really do. We’ve been accepting credit card payments for decades, and what was once a mere annoyance (“Hey, what’s this extra $0.06 fee for anyway?”) has transformed into an obsessive desire to help our clients get reasonable payment processing contracts and better-than-normal rates.

To this end, we can negotiate better-than-normal rates and payment processing contracts for our clients. We’d like to connect you with payment processing companies at our rates and our pre-negotiated contract terms, so that accepting credit card payments can actually benefit your business’s bottom line.